In 2020, LiveIn Co-founder and CEO, Keek Wen Khai (“Khai”), faced a critical moment. Just as the Malaysia-based long-stay property rental startup was set to venture into Thailand, COVID brought most industries to a sudden standstill.

At that time, proptech startups engaged in short-term budget hotels and co-working spaces witnessed a drastic decline in occupancy rates by over 80%. This as the COVID lockdowns restricted travel and forced businesses to transition to remote work. While LiveIn maintained a relatively stable position owing to the essential demand for leased homes, it was not immune to the pandemic. Its occupancy rates dropped to 60%.

LiveIn Co-founders: Joey Lim (CGO) and Keek Wen Khai (CEO)

Khai, Co-founder Joey Lim (Chief Growth Officer), and the rest of the team rallied together. Their primary focus was to navigate the crisis, which meant immediate measures like slashing costs by 40% to sustain their operations, and retaining as many tenant relationships as possible by switching to flexible rental terms. Additionally, they continued their hustle by offering virtual tours to attract new tenants. Thanks to all their efforts, they managed to restore occupancy rates to the usual 80-90% range across their managed properties within a few months, keeping the trust of property owners.

Despite the uncertainty, Khai did not miss the opportunity. He didn’t play it safe by delaying the Thailand expansion. He dove in and even relocated to Bangkok—a decision some would deem crazy at the time.

This decision was rooted in his firm belief in LiveIn’s value proposition. Unlike other proptechs relying on discretionary spending like tourism, LiveIn was addressing a compelling and long overlooked problem. Khai was confident that this problem would remain a massive opportunity once the world regained some normalcy.

“The market potential for LiveIn is undeniably promising. If we aimed to revolutionise the industry in five to 10 years, we couldn’t let a setback of one to two years halt our progress,” Khai emphasised.

LiveIn targets young adults (18 to 30 years old) relocating to urbanised Southeast Asian cities to build their careers or pursue higher education. As these individuals have relatively low income, they face a genuine pain point: the scarcity of affordable and quality rental properties. Add steadily rising inflation rates to the mix, and it becomes an even tougher challenge. In prime locations in cities, quality accommodations are expensive, while affordable options lack basic infrastructure. This ultimately means tradeoffs. You either reside far from your workplace to save on rent, enduring lengthy daily commutes, or settle for shoddy, unsecure living conditions in an ideal area.

In response, Khai and Joey introduced LiveIn. The platform, which started in 2019, aggregates fully-furnished rooms with necessary services across previously unutilised property buildings in second-tier locations, offering them at an average monthly rate of US$200, two to three times cheaper than market rates.

Much room for improvement: The image on the left shows a room in subpar condition compared to accommodations managed by LiveIn, as depicted on the right. Photos from LiveIn

Today, LiveIn stands as Southeast Asia’s largest long-term rental platform for co-living spaces, heading toward the 10,000-room mark. Not only that, the company’s Malaysia operations are profitable. Khai’s gamble on Thailand has paid off, as it is now LiveIn’s largest market. Furthermore, LiveIn is gearing up to expand into another market: Vietnam.

A distinct proptech approach

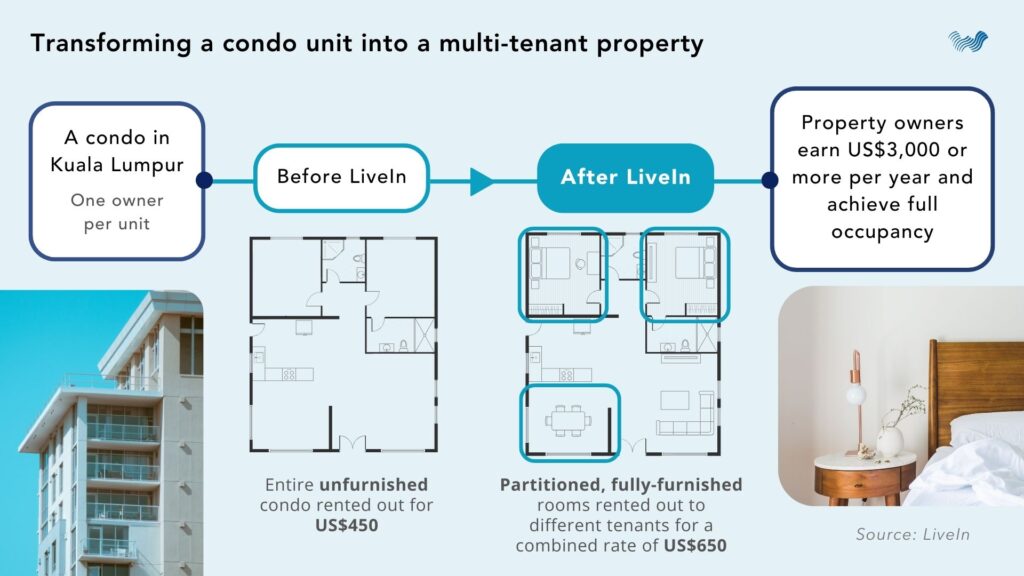

LiveIn’s core concept revolves around identifying underutilised or unutilised properties near prime locations that struggle to attract tenants or buyers, resulting in an oversupply issue. With guidance from LiveIn, the owners refurbish the properties, partitioning them into fully-furnished leasable rooms with common areas. This solves the concerns of young professionals seeking more affordable rooms in reasonable locations.

Meanwhile, property owners perceive a win-win solution despite the renovation costs. Through investing in upgrades, they profit from properties that might otherwise remain a burden by making them attractive in terms of rental rates and quality. Typically, these owners struggle with occupancy rates of 30% or less, which are inadequate to cover maintenance expenses. Additionally, renting out multiple rooms enables them to earn higher as compared to renting out the entire property as a single unit.

Although young adults typically have limited income, collectively, they present a lucrative opportunity. Consider this: more than half of Southeast Asia’s 680 million population falls within the working age bracket of under 30 years old. Termed the “demographic dividend,” this segment fuels rapid economic growth in the region—a trend that LiveIn aims to capitalise on.

LiveIn operates as an asset-light proptech company, refraining from property investment or bearing capital expenses for refurbishment, maintenance, and repairs. It also does not guarantee rental income for property owners. Previous property management models saw companies onboarding properties by renting them, leading to increased operational costs. These costs were subsequently passed onto tenants through higher rates. LiveIn, in contrast, provides a range of services, from refurbishment guidance to comprehensive tenant support, including the management of viewing, onboarding, and payment processes. Adding a twist to the co-living approach, LiveIn actively cultivates tenant communities founded on shared interests and experiences, a pivotal strategy aimed at boosting tenant retention.

HO CHI MINH CITY, VIETNAM, 9 APRIL 2024 – CNV, founded in 2020 by Nguyen Tuan Phu and Do Dang Khoa, is the leading cloud-based business and marketing solutions provider dedicated to offering digital transformation SaaS products and marketing growth services to assist MSMEs, SMEs, and enterprises in Vietnam achieve sustainable growth via marketing, loyalty and […]

Read moreHO CHI MINH CITY, VIETNAM, 9 APRIL 2024 – CNV, founded in 2020 by Nguyen Tuan Phu and Do Dang Khoa, is the leading cloud-based business and marketing solutions provider dedicated to offering digital transformation SaaS products and marketing growth services to assist MSMEs, SMEs, and enterprises in Vietnam achieve sustainable growth via marketing, loyalty and […]

Read moreHO CHI MINH CITY, VIETNAM, 9 APRIL 2024 – CNV, founded in 2020 by Nguyen Tuan Phu and Do Dang Khoa, is the leading cloud-based business and marketing solutions provider dedicated to offering digital transformation SaaS products and marketing growth services to assist MSMEs, SMEs, and enterprises in Vietnam achieve sustainable growth via marketing, loyalty and […]

Read moreLiveIn primarily generates revenue by taking a 20% cut of monthly rental payments. It ensures stable and predictable revenue by offering minimum six-month tenant contracts. It is also exploring new revenue streams such as commissions from ancillary services like cleaning and laundry services, as well as advertising opportunities in common areas like elevators and lobbies. While community activities such as yoga classes and tea-making workshops are initially free, LiveIn anticipates monetisation avenues as these programmes expand in the future.

Between 2019 and 2023, LiveIn has witnessed a 5x growth in its annual recurring revenue or ARR.

While building a sound business model is crucial, establishing credibility with property owners is equally important. According to Khai, this trust-building process can take anywhere from three months to 1.5 years. Even seemingly small matters, like convincing property owners about the importance of WiFi in the rooms, were some of LiveIn’s initial hurdles. However, as LiveIn fostered relationships with property owners and proved its value, it was able to grow organically.

“What we appreciate about Khai and Joey is their unwavering dedication to solving this real problem. Their sincerity became evident when COVID hit. They personally engaged with building owners, reaching out to each one individually, to explain their strategy for weathering the crisis. Of these owners, only three walked away. The rest said, ‘you know what, I trust you, I’ll continue to work with you,’” shared Joel Ang, Investment Principal at Wavemaker Partners.

Evolution to LiveIn: Overcoming the challenges

Khai and Joey didn’t establish the LiveIn model immediately. Rather, It was a culmination of insights gained over 10 years of experience in the real estate industry.

Before becoming entrepreneurs, Khai and Joey were real estate agents. Their experience led them to a crucial observation: a notable disparity in the house price-to-income ratio, particularly in Malaysia and other emerging markets in Southeast Asia. While the ideal ratio should be around 3.0 (where a house costs roughly 30% of one’s income), the reality often saw ratios between 4.0 and 4.4. This disparity made property ownership unfeasible for younger generations, pushing them into a perpetual cycle of renting.

The duo embarked on their first business venture in Malaysia in 2013, which turned out to be capital-intensive. The company engaged in buying its own properties, renovating and then renting them out. This eventually stood in the way of scaling. Fortunately, they sold the business to a larger property management company, and used the funds to start an online property marketplace in 2015 called HostelHunting. HostelHunting operated under an asset-light model, aggregating property listings and connecting students with landlords in Malaysia. The company was able to raise a total of nearly US$6 million in funding from investors like Jungle Ventures, Wavemaker Partners, and KK Fund, to name a few. However, despite initial success and expansion to Singapore and Thailand by 2018, HostelHunting faced issues that led to a pivot.

Since HostelHunting wasn’t directly managing the properties listed on its platform, it discovered instances where properties were misrepresented. The properties were either not furnished as advertised or did not match the standards portrayed in the pictures shared by property owners. Additionally, the company faced a branding problem: its name implied accommodations for backpackers, hindering its ability to reach its desired target market. Thus, in 2019, HostelHunting changed its positioning to the new co-living model, expanding its target market beyond students to include young professionals with more stable income sources. By 2020, it officially rebranded to LiveIn. While maintaining an asset-light approach, LiveIn opted to manage the properties itself to ensure consistent quality standards.

Throughout 2019, the company focused on operational efficiency. Managing the properties meant dealing with individual landlords and tenants, requiring headcount. To address this, LiveIn targeted entire buildings instead of individual units, which brought them economies of scale. By achieving density in onboarded properties within the areas they served, they streamlined property management operations, utilising a single office to cater to a certain radius.

But just as they were refining the model, COVID struck, presenting a challenge unlike any other.

LiveIn received back-to-back blows. Apart from seeing its occupancy rates drop, LiveIn was affected by the negative perceptions toward COVID-impacted proptechs such as tech-driven budget hotels. During their early stages, such companies operated at a loss due to their focus on rapid expansion, prioritising growth over profitability. They allocated substantial funds to marketing efforts aimed at acquiring a larger customer base and penetrating new markets. Furthermore, these startups faced intense competition, which compelled them to attract clients through discounts and incentives, consequently exerting significant pressure on their margins. As investors generally shied away from the proptech space, LiveIn struggled to secure new backing, relying on funds from existing investors instead.

“This is where curiosity is really important. If you were curious enough to understand LiveIn’s business model, why everyone else was struggling while LiveIn was still able to maintain occupancy at a relatively decent level, you would not have missed the opportunity,” said Wavemaker’s Joel Ang.

Despite these setbacks, LiveIn persisted. While dealing with COVID challenges, the company leveraged the slow period to expand its portfolio, with the addition of Thailand. Thailand, after all, had less strict lockdown policies compared to some markets in Southeast Asia. Khai relocated to Bangkok to personally build relationships with property owners, helping bolster LiveIn’s reputation. Expanding their property network during the pandemic positioned LiveIn well, allowing it to hit the ground running as soon as markets opened.

Today, the company is nearing the completion of its pre-Series B funding round.

LiveIn’s Southeast Asia expansion strategy

The LiveIn team

While LiveIn continues its organic growth, it also actively pursues strategic mergers and acquisitions (M&As) to expand further.

In fact, in May 2023, LiveIn completed the acquisition of KT Management in Malaysia. The company manages a prominent student accommodation facility in Kampar, Perak. This strategic move allows LiveIn to target students in the area, providing them with housing options from their university years until they transition into the workforce post-graduation.

“Traditional players struggle with scalability and lack exit plans—these are their pain points,” said Khai. “We offer them an exit strategy and, in return, integrate their operations into our platform. This benefits both by scaling their businesses and expanding our coverage to serve more tenants.”

Wavemaker’s Joel added, “LiveIn will only proceed if they can acquire a portfolio of properties at a fair price and if there’s alignment with the existing team. This alignment is crucial to effectively apply the LiveIn playbook, ensuring seamless integration and immediate implementation.”

The founders recognise that as LiveIn expands, managing properties across different cities and countries will be a challenge. They aim to overcome this by maintaining positive unit economics and recruiting top-notch local talent to support the vision.

Khai and Joey’s commitment to solving a real problem from the outset was central to the company’s growth. By prioritising tenant and landlord needs and delivering tangible value despite tough market conditions, they tackled the shortage in affordable yet quality rental properties and created positive revenue streams. Their dedication resonated with the demographic they aimed to serve, resulting in continued demand for their offerings.

With a solid strategy and expansion plans in motion, LiveIn aims to continue expanding its footprint in Southeast Asia. “Our aspiration is to cover every city in the region, offering young people the flexibility to live according to their chosen lifestyles,” Khai asserted. “Beyond providing quality living spaces, our goal is to foster a sense of community through various programmes across the properties we manage.”

“Most people move to the city in pursuit of a better life and opportunities, but for many, this remains a distant dream,” Khai reflected. “We’re motivated by the happiness of our tenants. Witnessing improvements in their lives fuels our determination to keep pushing forward.”

Edited by Jum Balea